Will the USD be able to maintain its upward momentum against the CHF?

USDCHF Analysis and Forecast

Weekly Overview

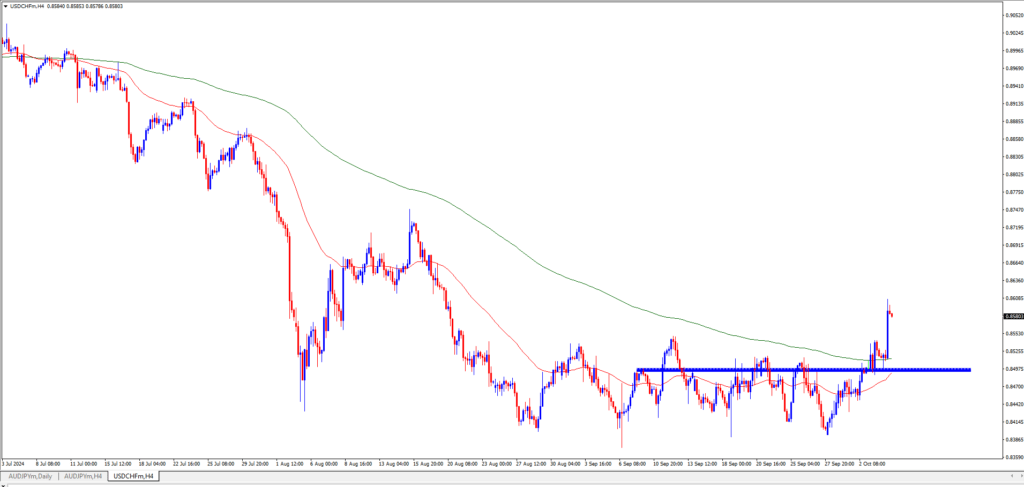

Last week, the USDCHF pair experienced a solid upward trend, rising for five consecutive days. The price rebounded from the key support level of 0.8400, closing the week around 0.8590 to 0.8600. A significant development is the breakout above the 50 EMA (Exponential Moving Average) on the daily chart, where the price has managed to hold above this level.

4-Hour Chart Insights

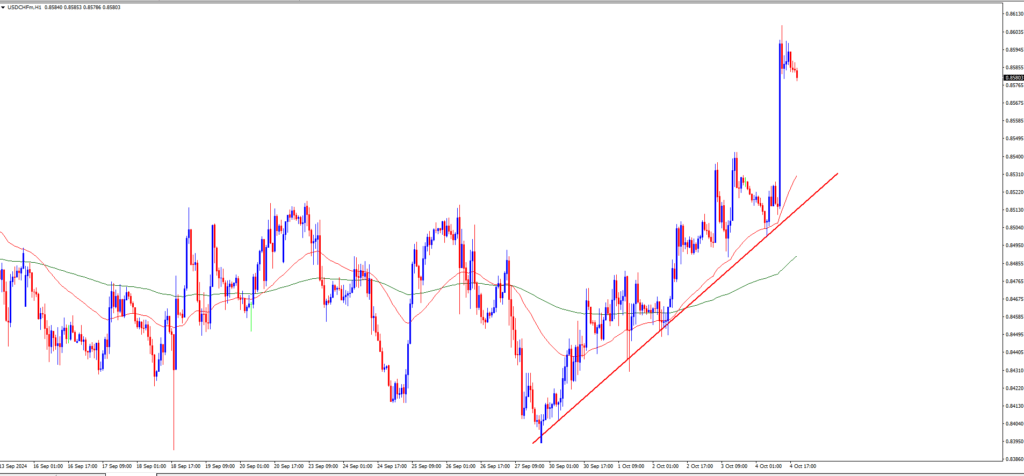

In the 4-hour time frame, USDCHF also broke above both the 50 EMA and 200 EMA, positioning itself comfortably above these indicators. The current price is resting at 0.8580, with the EMAs acting as short-term support at around 0.8500.

Short-Term Analysis

Zooming into the 1-hour chart, we see that the 50 EMA has crossed above the 200 EMA, signaling a bullish trend. The price has pulled back several times to touch the 50 EMA, each time continuing its upward movement, reinforcing a short-term bullish outlook.

USDCHF forecast

We expect USDCHF to maintain its upward momentum in the upcoming sessions. There’s potential for the price to reach 0.8650, with immediate short-term support levels at 0.8530 and 0.8490. However, if the price falls below 0.8490 and sustains at that level, it may test further support at 0.8456.

Our Position

Overall, we are bullish on USDCHF.

For the latest USDCHF analysis and much more, visit USDCHF technical analysis